Multiple Choice

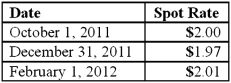

On October 1, 2011, Eagle Company forecasts the purchase of inventory from a British supplier on February 1, 2012, at a price of 100,000 British pounds. On October 1, 2011, Eagle pays $1,800 for a three-month call option on 100,000 pounds with a strike price of $2.00 per pound. The option is considered to be a cash flow hedge of a forecasted foreign currency transaction. On December 31, 2011, the option has a fair value of $1,600. The following spot exchange rates apply:  What is the amount of Cost of Goods Sold for 2012 as a result of these transactions?

What is the amount of Cost of Goods Sold for 2012 as a result of these transactions?

A) $200,000.

B) $195,000.

C) $201,000.

D) $202,600.

E) $203,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Brisco Bricks purchases raw material from its

Q2: Norton Co., a U.S. corporation, sold inventory

Q4: Coyote Corp. (a U.S. company in Texas)

Q8: Coyote Corp. (a U.S. company in Texas)

Q9: All of the following data may be

Q10: On October 1, 2011, Jarvis Co. sold

Q38: U.S. GAAP provides guidance for hedges of

Q65: Yelton Co.just sold inventory for 80,000 euros,

Q80: What happens when a U.S. company sells

Q83: What is the major assumption underlying the