Essay

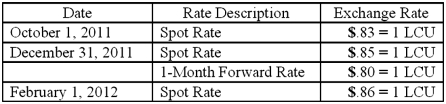

On October 1, 2011, Jarvis Co. sold inventory to a customer in a foreign country, denominated in 100,000 local currency units (LCU). Collection is expected in four months. On October 1, 2011, a forward exchange contract was acquired whereby Jarvis Co. was to pay 100,000 LCU in four months (on February 1, 2012) and receive $78,000 in U.S. dollars. The spot and forward rates for the LCU were as follows:  The company's borrowing rate is 12%. The present value factor for one month is .9901.

The company's borrowing rate is 12%. The present value factor for one month is .9901.

Any discount or premium on the contract is amortized using the straight-line method.

Assuming this is a cash flow hedge; prepare journal entries for this sales transaction and forward contract.

Correct Answer:

Verified

1 [(.80 - .78) 100,0...

1 [(.80 - .78) 100,0...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q15: A spot rate may be defined as<br>A)

Q16: A U.S. company sells merchandise to a

Q23: Which of the following statements is true

Q39: Williams, Inc., a U.S.company, has a Japanese

Q39: On May 1, 2011, Mosby Company received

Q41: On October 1, 2011, Eagle Company forecasts

Q46: Car Corp. (a U.S.-based company) sold parts

Q49: On April 1, Quality Corporation, a U.S.

Q50: For each of the following situations, select

Q60: What is meant by the spot rate?