Multiple Choice

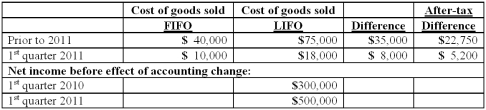

Baker Corporation changed from the LIFO method to the FIFO method for inventory valuation during 2011. Baker has an effective income tax rate of 30 percent and 100,000 shares of common stock issued and outstanding. The following additional information is available:  Assuming Baker makes the change in the first quarter of 2011, compute net income per common share.

Assuming Baker makes the change in the first quarter of 2011, compute net income per common share.

A) $4.92.

B) $4.95.

C) $5.00.

D) $5.05.

E) $5.28.

Correct Answer:

Verified

Correct Answer:

Verified

Q19: A company that generates reports by both

Q27: What is the appropriate treatment in an

Q33: Which of the following is not a

Q47: Which of the following is a criterion

Q50: What two disclosure guidelines for operating segment

Q55: Kaycee Corporation's revenues for the year ended

Q57: Gregor Inc. uses the LIFO cost-flow assumption

Q58: Faru Co. identified five industry segments: (1)

Q58: What is the appropriate treatment in an

Q62: Whitley Corporation identified four operating segments: Automotive,