Essay

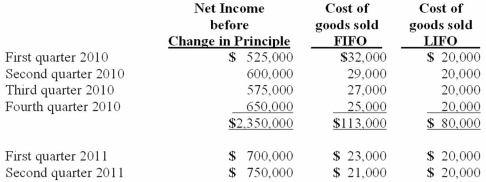

Harrison Company, Inc. began operations on January 1, 2010, and applied the LIFO method for inventory valuation. On June 10, 2011, Harrison adopted the FIFO method of accounting for inventory. Additional information is as follows:  The LIFO method was applied during the first quarter of 2011 and the FIFO method was applied during the second quarter of 2011 in computing income, above. Harrison's effective income tax rate is 40 percent. Harrison has 500,000 shares of common stock outstanding at all times.

The LIFO method was applied during the first quarter of 2011 and the FIFO method was applied during the second quarter of 2011 in computing income, above. Harrison's effective income tax rate is 40 percent. Harrison has 500,000 shares of common stock outstanding at all times.

Compute the after-tax effect of Harrison's change in inventory method.

Correct Answer:

Verified

Correct Answer:

Verified

Q5: Which one of the following items is

Q20: Which of the following statements is true?<br>A)

Q27: What is the appropriate treatment in an

Q28: Which of the following is not true

Q30: For each of the following situations, select

Q34: What approach is used, according to U.S.

Q52: The following information for Urbanski Corporation relates

Q55: Kaycee Corporation's revenues for the year ended

Q58: What is the appropriate treatment in an

Q61: How are extraordinary gains reported in a