Multiple Choice

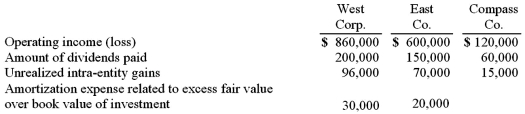

West Corp. owned 70% of the voting common stock of East Co. East owned 60% of Compass Co. West and East both used the initial value method to account for their investments. The following information was available from the financial statements and records of the three companies:  Operating income included unrealized intra-entity gains (which are related to inventory transfers) but did not include dividend income from investment in subsidiary. For West Corp. and consolidated subsidiaries, what total amount would have been reported for the non-controlling interest's share of subsidiaries' net income?

Operating income included unrealized intra-entity gains (which are related to inventory transfers) but did not include dividend income from investment in subsidiary. For West Corp. and consolidated subsidiaries, what total amount would have been reported for the non-controlling interest's share of subsidiaries' net income?

A) $165,300.

B) $199,300.

C) $191,000.

D) $228,000.

E) $153,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q9: White Company owns 60% of Cody Company.

Q10: On January 1, 2010, Mace Co. acquired

Q13: Delta Corporation owns 90 percent of Sigma

Q15: Tate, Inc. owns 80 percent of Jeffrey,

Q18: River Co. owned 80% of Boat Inc.

Q19: B Co. owned 70% of the voting

Q58: Which of the following statements is true

Q61: Which of the following is true concerning

Q83: Which of the following is not an

Q112: X Co. owned 80% of Y Corp.,