Multiple Choice

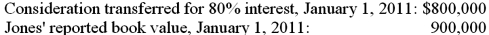

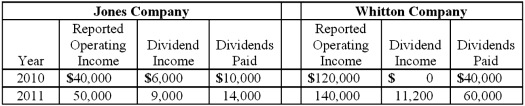

On January 1, 2010, Jones Company bought 15% of Whitton Company. Jones paid $150,000 for these shares, an amount that exactly equaled the proportionate book value of Whitton. On January 1, 2011, Whitton acquired 80% ownership of Jones. The following data are available concerning Whitton's acquisition of Jones:  Excess fair value over book value (assigned to trademarks) is amortized over 20 years. The initial value method is used by both companies.

Excess fair value over book value (assigned to trademarks) is amortized over 20 years. The initial value method is used by both companies.

The following information is available regarding Jones and Whitton:  What would be included in a consolidation worksheet entry for 2011?

What would be included in a consolidation worksheet entry for 2011?

A) Debit treasury stock, $135,000.

B) Credit treasury stock, $135,000.

C) Debit treasury stock, $150,000.

D) Credit treasury stock, $150,000.

E) Debit common stock, $150,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q14: Pear, Inc. owns 80 percent of Apple

Q19: Evanston Co. owned 60% of Montgomery Corp.

Q60: C Co. currently owns 80% of D

Q90: Which of the following statements is true

Q105: Beagle Co. owned 80% of Maroon Corp.

Q107: Why might a consolidated group file separate

Q107: What are the benefits or advantages of

Q108: On January 1, 2011, a subsidiary buys

Q109: Alpha Corporation owns 100 percent of Beta

Q112: Hardford Corp. held 80% of Inglestone Inc.