Multiple Choice

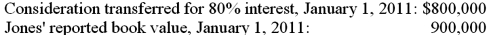

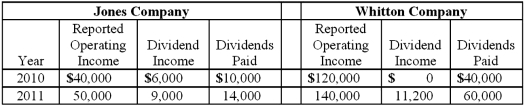

On January 1, 2010, Jones Company bought 15% of Whitton Company. Jones paid $150,000 for these shares, an amount that exactly equaled the proportionate book value of Whitton. On January 1, 2011, Whitton acquired 80% ownership of Jones. The following data are available concerning Whitton's acquisition of Jones:  Excess fair value over book value (assigned to trademarks) is amortized over 20 years. The initial value method is used by both companies.

Excess fair value over book value (assigned to trademarks) is amortized over 20 years. The initial value method is used by both companies.

The following information is available regarding Jones and Whitton:  Compute Whitton's accrual-based consolidated net income for 2011.

Compute Whitton's accrual-based consolidated net income for 2011.

A) $199,000.

B) $190,000.

C) $185,000.

D) $184,000.

E) $176,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q17: For each of the following situations, select

Q27: What ownership pattern is referred to as

Q67: Paris, Inc. owns 80 percent of the

Q68: Jull Corp. owned 80% of Solaver Co.

Q69: Chase Company owns 80% of Lawrence Company

Q71: Delta Corporation owns 90 percent of Sigma

Q73: On January 1, 2011, a subsidiary bought

Q75: Tower Company owns 85% of Hill Company.

Q77: Prescott Corp. owned 90% of Bell Inc.,

Q83: Explain how the treasury stock approach treats