Multiple Choice

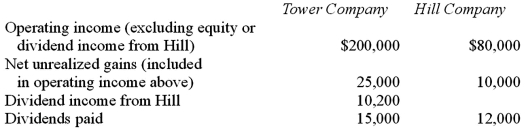

Tower Company owns 85% of Hill Company. The two companies engaged in several intra-entity transactions. Each company's operating and dividend income for the current time period follow, as well as the effects of unrealized gains. No income tax accruals have been recognized within these totals. The tax rate for each company is 30%.  Compute accrual-based consolidated net income.

Compute accrual-based consolidated net income.

A) $280,000.

B) $245,000.

C) $200,000.

D) $255,200.

E) $290,200.

Correct Answer:

Verified

Correct Answer:

Verified

Q3: Alpha Corporation owns 100 percent of Beta

Q5: Alpha Corporation owns 100 percent of Beta

Q6: River Co. owned 80% of Boat Inc.

Q7: Hardford Corp. held 80% of Inglestone Inc.

Q8: On January 1, 2011, a subsidiary buys

Q9: White Company owns 60% of Cody Company.

Q10: On January 1, 2010, Mace Co. acquired

Q15: Tate, Inc. owns 80 percent of Jeffrey,

Q66: Tate, Inc. owns 80 percent of Jeffrey,

Q67: Which of the following statements is true