Multiple Choice

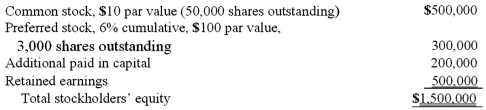

On January 1, 2009, Nichols Company acquired 80% of Smith Company's common stock and 40% of its non-voting, cumulative preferred stock. The consideration transferred by Nichols was $1,200,000 for the common and $124,000 for the preferred. Any excess acquisition-date fair value over book value is considered goodwill. The capital structure of Smith immediately prior to the acquisition is:  Determine the amount and account to be recorded for Nichols' investment in Smith.

Determine the amount and account to be recorded for Nichols' investment in Smith.

A) $1,324,000 for Investment in Smith.

B) $1,200,000 for Investment in Smith.

C) $1,200,000 for Investment in Smith's Common Stock and $124,000 for Investment in Smith's Preferred Stock.

D) $1,200,000 for Investment in Smith's Common Stock and $120,000 for Investment in Smith's Preferred Stock.

E) $1,448,000 for Investment in Smith's Common Stock.

Correct Answer:

Verified

Correct Answer:

Verified

Q45: Which of the following characteristics is not

Q50: Parent Corporation loaned money to its subsidiary

Q54: The following information has been taken from

Q83: When a company has preferred stock in

Q90: Rojas Co. owned 7,000 shares (70%) of

Q91: The following information has been taken from

Q98: How are intra-entity inventory transfers treated on

Q101: Ryan Company owns 80% of Chase Company.

Q108: Fargus Corporation owned 51% of the voting

Q109: Anderson, Inc. has owned 70% of its