Multiple Choice

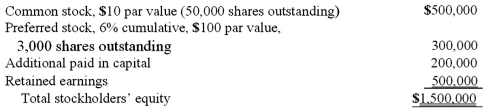

On January 1, 2009, Nichols Company acquired 80% of Smith Company's common stock and 40% of its non-voting, cumulative preferred stock. The consideration transferred by Nichols was $1,200,000 for the common and $124,000 for the preferred. Any excess acquisition-date fair value over book value is considered goodwill. The capital structure of Smith immediately prior to the acquisition is:  Compute the non-controlling interest in Smith at date of acquisition.

Compute the non-controlling interest in Smith at date of acquisition.

A) $486,000.

B) $480,000.

C) $300,000.

D) $150,000.

E) $120,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q8: Which of the following statements is false

Q49: A parent acquires 70% of a subsidiary's

Q64: Pursley, Inc. owns 70 percent of Harry,

Q65: Allen Co. held 80% of the common

Q66: The balance sheets of Butler, Inc. and

Q66: MacDonald, Inc.owns 80 percent of the outstanding

Q69: On January 1, 2011, Riley Corp. acquired

Q70: Cadion Co. owned a controlling interest in

Q72: Franklin Corporation owns 90 percent of the

Q78: Which one of the following characteristics of