Essay

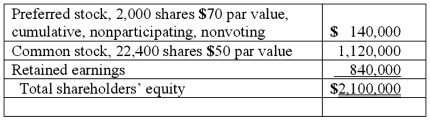

On January 1, 2011, Bast Co. had a net book value of $2,100,000 as follows:  Fisher Co. acquired all of the outstanding preferred shares for $148,000 and 60% of the common stock for $1,281,000. Fisher believed that one of Bast's buildings, with a twelve-year life, was undervalued on the company's financial records by $70,000.

Fisher Co. acquired all of the outstanding preferred shares for $148,000 and 60% of the common stock for $1,281,000. Fisher believed that one of Bast's buildings, with a twelve-year life, was undervalued on the company's financial records by $70,000.

Required:

What is the amount of goodwill to be recognized from this purchase?

Correct Answer:

Verified

Correct Answer:

Verified

Q6: Parent Corporation acquired some of its subsidiary's

Q33: The following information has been taken from

Q44: The following information has been taken from

Q50: On January 1, 2011, Riney Co. owned

Q51: A parent company owns a 70 percent

Q52: Skipen Corp. had the following stockholders' equity

Q54: Ryan Company owns 80% of Chase Company.

Q57: Webb Company owns 90% of Jones Company.

Q66: The following information has been taken from

Q84: A variable interest entity can take all