Multiple Choice

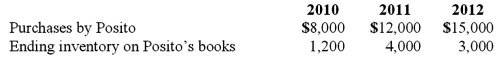

Gargiulo Company, a 90% owned subsidiary of Posito Corporation, sells inventory to Posito at a 25% profit on selling price. The following data are available pertaining to intra-entity purchases. Gargiulo was acquired on January 1, 2010.  Assume the equity method is used. The following data are available pertaining to Gargiulo's income and dividends.

Assume the equity method is used. The following data are available pertaining to Gargiulo's income and dividends.  Compute the non-controlling interest in Gargiulo's net income for 2011.

Compute the non-controlling interest in Gargiulo's net income for 2011.

A) $8,500.

B) $8,570.

C) $8,430.

D) $8,400.

E) $7,580.

Correct Answer:

Verified

Correct Answer:

Verified

Q53: How is the gain on an intra-entity

Q54: Which of the following statements is true

Q93: When is the gain on an intra-entity

Q108: On January 1, 2011, Payton Co. sold

Q109: Wilson owned equipment with an estimated life

Q110: Throughout 2011, Cleveland Co. sold inventory to

Q114: Wilson owned equipment with an estimated life

Q115: Gargiulo Company, a 90% owned subsidiary of

Q116: Norek Corp. owned 70% of the voting

Q117: Yukon Co. acquired 75% percent of the