Multiple Choice

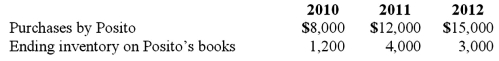

Gargiulo Company, a 90% owned subsidiary of Posito Corporation, sells inventory to Posito at a 25% profit on selling price. The following data are available pertaining to intra-entity purchases. Gargiulo was acquired on January 1, 2010.  Assume the equity method is used. The following data are available pertaining to Gargiulo's income and dividends.

Assume the equity method is used. The following data are available pertaining to Gargiulo's income and dividends.  For consolidation purposes, what amount would be debited to January 1 retained earnings for the 2012 consolidation worksheet entry with regard to the unrealized gross profit of the 2011 intra-entity transfer of merchandise?

For consolidation purposes, what amount would be debited to January 1 retained earnings for the 2012 consolidation worksheet entry with regard to the unrealized gross profit of the 2011 intra-entity transfer of merchandise?

A) $3,000.

B) $2,400.

C) $1,000.

D) $800.

E) $900.

Correct Answer:

Verified

Correct Answer:

Verified

Q21: Gargiulo Company, a 90% owned subsidiary of

Q22: McGraw Corp. owned all of the voting

Q23: Gargiulo Company, a 90% owned subsidiary of

Q24: Stiller Company, an 80% owned subsidiary of

Q25: Stark Company, a 90% owned subsidiary of

Q28: Virginia Corp. owned all of the voting

Q29: Stiller Company, an 80% owned subsidiary of

Q30: Strickland Company sells inventory to its parent,

Q31: Justings Co. owned 80% of Evana Corp.

Q94: Which of the following statements is true