Multiple Choice

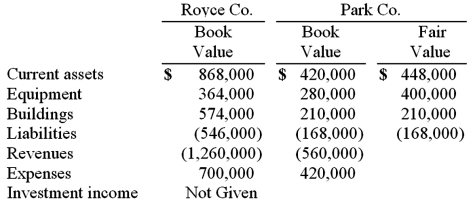

Royce Co. acquired 60% of Park Co. for $420,000 on December 31, 2010 when Park's book value was $560,000. The Royce stock was not actively traded. On the date of acquisition, Park had equipment (with a ten-year life) that was undervalued in the financial records by $140,000. One year later, the following selected figures were reported by the two companies. Additionally, no dividends have been paid.  What is the non-controlling interest's share of the subsidiary's net income for the year ended December 31, 2011 and what is the ending balance of the non-controlling interest in the subsidiary at December 31, 2011?

What is the non-controlling interest's share of the subsidiary's net income for the year ended December 31, 2011 and what is the ending balance of the non-controlling interest in the subsidiary at December 31, 2011?

A) $56,000 and $280,000.

B) $50,400 and $218,400.

C) $56,000 and $224,000.

D) $56,000 and $336,000.

E) $50,400 and $330,400.

Correct Answer:

Verified

Correct Answer:

Verified

Q19: When a parent uses the equity method

Q24: Pell Company acquires 80% of Demers Company

Q25: Pennant Corp. owns 70% of the common

Q26: McGuire Company acquired 90 percent of Hogan

Q28: Pell Company acquires 80% of Demers Company

Q29: Pell Company acquires 80% of Demers Company

Q30: Beta Corp. owns less than one hundred

Q31: On January 1, 2010, Palk Corp. and

Q77: What is pre-acquisition income?

Q100: Perch Co. acquired 80% of the common