Essay

On January 1, 2009, Vacker Co. acquired 70% of Carper Inc. by paying $650,000. This included a $20,000 control premium. Carper reported common stock on that date of $420,000 with retained earnings of $252,000. A building was undervalued in the company's financial records by $28,000. This building had a ten-year remaining life. Copyrights of $80,000 were to be recognized and amortized over 20 years.

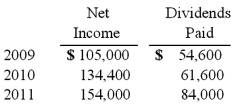

Carper earned income and paid cash dividends as follows:  On December 31, 2011, Vacker owed $30,800 to Carper. There have been no changes in Carper's common stock account since the acquisition.

On December 31, 2011, Vacker owed $30,800 to Carper. There have been no changes in Carper's common stock account since the acquisition.

Required:

If the equity method had been applied by Vacker for this acquisition, what were the consolidation entries needed as of December 31, 2011?

Correct Answer:

Verified

From the acquisition value, $28,000 was ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q4: All of the following statements regarding the

Q4: Pell Company acquires 80% of Demers Company

Q5: In measuring non-controlling interest at the date

Q6: Pell Company acquires 80% of Demers Company

Q7: On January 1, 2010, Jannison Inc. acquired

Q8: McGuire Company acquired 90 percent of Hogan

Q10: Pell Company acquires 80% of Demers Company

Q12: Pell Company acquires 80% of Demers Company

Q103: Alonzo Co.acquired 60% of Beazley Corp.by paying

Q105: How is a noncontrolling interest in the