Essay

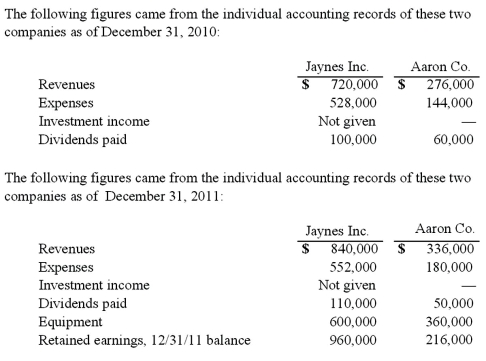

Jaynes Inc. acquired all of Aaron Co.'s common stock on January 1, 2010, by issuing 11,000 shares of $1 par value common stock. Jaynes' shares had a $17 per share fair value. On that date, Aaron reported a net book value of $120,000. However, its equipment (with a five-year remaining life) was undervalued by $6,000 in the company's accounting records. Any excess of consideration transferred over fair value of assets and liabilities is assigned to an unrecorded patent to be amortized over ten years.  What was the total for consolidated patents as of December 31, 2011?

What was the total for consolidated patents as of December 31, 2011?

Correct Answer:

Verified

Correct Answer:

Verified

Q7: One company acquires another company in a

Q35: For an acquisition when the subsidiary retains

Q35: Pritchett Company recently acquired three businesses, recognizing

Q36: Perry Company acquires 100% of the stock

Q38: Perry Company acquires 100% of the stock

Q41: Fesler Inc. acquired all of the outstanding

Q43: Pritchett Company recently acquired three businesses, recognizing

Q69: All of the following are acceptable methods

Q87: When consolidating a subsidiary under the equity

Q105: What advantages might push-down accounting offer for