Essay

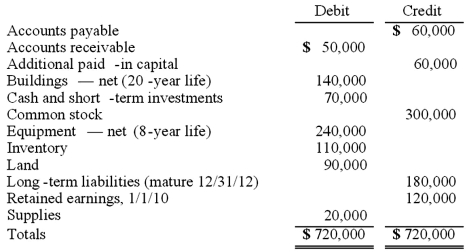

Matthews Co. acquired all of the common stock of Jackson Co. on January 1, 2010. As of that date, Jackson had the following trial balance:  During 2010, Jackson reported net income of $96,000 while paying dividends of $12,000. During 2011, Jackson reported net income of $132,000 while paying dividends of $36,000.

During 2010, Jackson reported net income of $96,000 while paying dividends of $12,000. During 2011, Jackson reported net income of $132,000 while paying dividends of $36,000.

Assume that Matthews Co. acquired the common stock of Jackson Co. for $588,000 in cash. As of January 1, 2010, Jackson's land had a fair value of $102,000, its buildings were valued at $188,000, and its equipment was appraised at $216,000. Any excess of consideration transferred over fair value of assets and liabilities acquired is due to an unamortized patent to be amortized over 10 years.

Matthews decided to use the equity method for this investment.

Required:

(A.) Prepare consolidation worksheet entries for December 31, 2010.

(B.) Prepare consolidation worksheet entries for December 31, 2011.

Correct Answer:

Verified

Correct Answer:

Verified

Q10: Yules Co. acquired Noel Co. in an

Q74: Harrison, Inc. acquires 100% of the voting

Q75: Watkins, Inc. acquires all of the outstanding

Q76: Goehler, Inc. acquires all of the voting

Q77: On 4/1/09, Sey Mold Corporation acquired 100%

Q79: Following are selected accounts for Green Corporation

Q80: Goehler, Inc. acquires all of the voting

Q81: Perry Company acquires 100% of the stock

Q82: Perry Company acquires 100% of the stock

Q83: Perry Company acquires 100% of the stock