Essay

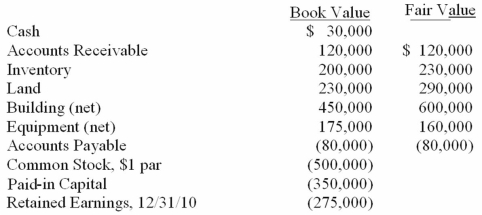

On January 1, 2011, Chester Inc. acquired 100% of Festus Corp.'s outstanding common stock by exchanging 37,500 shares of Chester's $2 par value common voting stock. On January 1, 2011, Chester's voting common stock had a fair value of $40 per share. Festus' voting common shares were selling for $6.50 per share. Festus' balances on the acquisition date, just prior to acquisition are listed below.  Required:

Required:

Compute the value of the Goodwill account on the date of acquisition, 1/1/11.

Correct Answer:

Verified

Correct Answer:

Verified

Q3: How is contingent consideration accounted for in

Q4: How are stock issuance costs and direct

Q6: In a transaction accounted for using the

Q47: Which of the following statements is true

Q51: Using the acquisition method for a business

Q105: The financial statements for Goodwin, Inc., and

Q109: The financial statements for Goodwin, Inc., and

Q110: The financial statements for Goodwin, Inc., and

Q111: Flynn acquires 100 percent of the outstanding

Q113: In an acquisition where control is achieved,