Essay

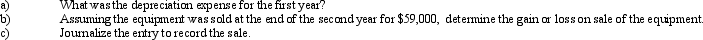

Equipment was acquired at the beginning of the year at a cost of $75,000.The equipment was depreciated using the straight-line method based upon an estimated useful life of 6 years and an estimated residual value of $7,500.

Correct Answer:

Verified

a)$11,250

...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q58: When determining whether to record an asset

Q61: A fixed asset with a cost of

Q87: On June 1, 2014, Aaron Company purchased

Q89: Williams Company acquired machinery on July 1,

Q104: A capitalized asset will appear on the

Q106: The process of transferring the cost of

Q139: Golden Sales has bought $135,000 in fixed

Q150: Computer equipment was acquired at the beginning

Q151: When a company establishes an outstanding reputation

Q206: Costs associated with normal research and development