Essay

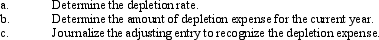

Solare Company acquired mineral rights for $60,000,000.The diamond deposit is estimated at 6,000,000 tons.During the current year,2,300,000 tons were mined and sold.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q35: The depreciation method that does not use

Q45: Journalize each of the following transactions:<br> <img

Q63: Accumulated Depreciation<br>A) is used to show the

Q71: The cost of replacing an engine in

Q85: A double-declining balance rate for calculating depreciation

Q115: Computer equipment was acquired at the beginning

Q126: On December 31, Strike Company has decided

Q144: The double-declining-balance depreciation method calculates depreciation each

Q174: Regardless of the depreciation method, the amount

Q183: The cost of new equipment is called