Essay

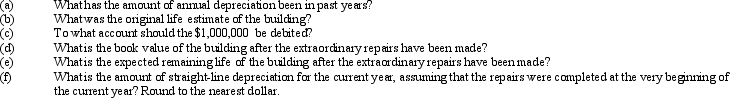

A number of major structural repairs completed at the beginning of the current fiscal year at a cost of $1,000,000 are expected to extend the life of a building 10 years beyond the original estimate.The original cost of the building was $6,552,000,and it has been depreciated by the straight-line method for 25 years.Estimated residual value is negligible and has been ignored.The related accumulated depreciation account after the depreciation adjustment at the end of the preceding fiscal year is $4,550,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q7: On December 31, Strike Company has decided

Q39: When a company exchanges machinery and receives

Q44: The calculation for annual depreciation using the

Q52: Which of the following is included in

Q118: If a fixed asset, such as

Q123: When cities give land or buildings to

Q125: The normal balance of the accumulated depreciation

Q134: When a company discards machinery that is

Q140: An estimate of the amount which an

Q165: The amount of depreciation expense for the