Essay

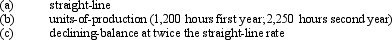

Equipment purchased at the beginning of the fiscal year for $360,000 is expected to have a useful life of 5 years,or 14,000 operating hours,and a residual value of $10,000.Compute the depreciation for the first and second years of use by each of the following methods:

(Round the answer to the nearest dollar. )

Correct Answer:

Verified

Correct Answer:

Verified

Q3: An intangible asset is one that has

Q33: Falcon Company acquired an adjacent lot to

Q88: An operating lease is accounted for as

Q122: Fixed assets are ordinarily presented in the

Q125: On June 1,2014,Aaron Company purchased equipment at

Q129: Identify each of the following expenditures as

Q130: It is necessary for a company to

Q131: Macon Co.acquired drilling rights for $7,500,000.The oil

Q132: Revising depreciation estimates does affect the amounts

Q133: Equipment costing $80,000 with a useful life