Essay

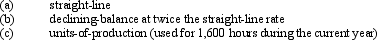

Machinery is purchased on July 1 of the current fiscal year for $240,000.It is expected to have a useful life of 4 years,or 25,000 operating hours,and a residual value of $15,000.Compute the depreciation for the last six months of the current fiscal year ending December 31 by each of the following methods:

(Round the answer to the nearest dollar. )

Correct Answer:

Verified

Correct Answer:

Verified

Q2: On June 1, 2014, Aaron Company purchased

Q32: On July 1,2010,Howard Co.acquired patents rights for

Q60: Determine the depreciation, for the year of

Q71: A capital lease is accounted for as

Q71: The cost of replacing an engine in

Q126: On December 31, Strike Company has decided

Q137: The term applied to the amount of

Q144: The double-declining-balance depreciation method calculates depreciation each

Q174: Regardless of the depreciation method, the amount

Q183: The cost of new equipment is called