Essay

On July 1st,Harding Construction purchases a bulldozer for $228,000.The equipment has a 8 year life with a residual value of $16,000.Harding uses straight-line depreciation.

(a)Calculate the depreciation expense and provide the journal entry for the first year ending December 31st.

(b)Calculate the third year's depreciation expense and provide the journal entry for the third year ending December 31st.

(c)Calculate the last year's depreciation expense and provide the journal entry for the last year.

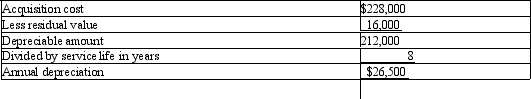

Annual depreciation is:

Correct Answer:

Verified

(a)First year depreciation is $26,500 ´ ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q3: An intangible asset is one that has

Q36: All property, plant, and equipment assets are

Q51: When depreciation estimates are revised, all years

Q72: If a fixed asset with a book

Q122: Fixed assets are ordinarily presented in the

Q129: The cost of repairing damage to a

Q137: Fill in the missing numbers using the

Q141: Identify the following as a Fixed Asset

Q142: For income tax purposes most companies use

Q167: Factors contributing to a decline in the