Essay

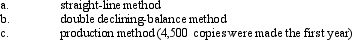

A copy machine acquired with a cost of $1,410 has an estimated useful life of 4 years. It is also expected to have a useful operating life of 13,350 copies.Assuming that it will have a residual value of $75,determine the depreciation for the first year by the

Correct Answer:

Verified

b.Double-...

b.Double-...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q12: An asset was purchased for $58,000 and

Q16: XYZ Co. incurred the following costs related

Q38: The amount of depreciation expense for a

Q42: Equipment with a cost of $160,000, an

Q67: When exchanging equipment, if the trade-in allowance

Q93: A fixed asset with a cost of

Q102: An asset was purchased for $120,000 on

Q168: Residual value is incorporated in the initial

Q180: Though a piece of equipment is still

Q215: Functional depreciation occurs when a fixed asset