Essay

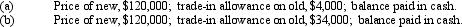

Machinery acquired at a cost of $80,000 and on which there is accumulated depreciation of $55,000 (including depreciation for the current year to date)is exchanged for similar machinery.For financial reporting purposes,present entries to record the disposition of the old machinery and the acquisition of new machinery under each of the following assumptions:

Correct Answer:

Verified

Correct Answer:

Verified

Q43: Which of the following is included in

Q46: The Bacon Company acquired new machinery with

Q100: Long-lived assets held for sale are classified

Q101: When old equipment is traded in for

Q102: An asset was purchased for $120,000 on

Q123: A gain can be realized when a

Q129: Assets may be grouped according to common

Q155: A machine costing $85,000 with a 5-year

Q168: Residual value is incorporated in the initial

Q215: Functional depreciation occurs when a fixed asset