Grizzly Company Grizzly Company Manufactures Footballs.The Forecasted Income Statement for the Year

Multiple Choice

Grizzly Company

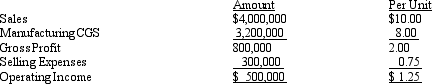

Grizzly Company manufactures footballs.The forecasted income statement for the year before any special orders is as follows:

Refer to Grizzly Company.Fixed costs included in the above forecasted income statement are $1,200,000 in manufacturing CGS and $100,000 in selling expenses.Grizzly received a special order offering to buy 50,000 footballs for $7.50 each.There will be no additional selling expenses if Grizzly accepts.Assume Grizzly has sufficient capacity to manufacture 50,000 more footballs.The unit relevant cost for Grizzly's decision is

A) $8.00

B) $5.00

C) $8.75

D) $5.75

Correct Answer:

Verified

Correct Answer:

Verified

Q31: In deciding whether to manufacture a part

Q32: Which of the following is a method

Q33: For the past 10 years,Husky Company has

Q34: Which product pricing factor is primarily used

Q35: With just-in-time inventory,what does a firm attempt

Q37: During the joint production process,the costs incurred

Q38: Dropping a product line.Timepiece Products,a clock manufacturer,operates

Q39: The theory of constraints focuses on which

Q40: Which product pricing practice is used by

Q41: The theory of constraints identifies bottlenecks and