Essay

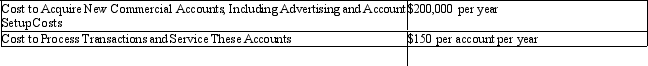

Customer profitability analysis.ChoiceBank's management is evaluating the profitability of providing special checking accounts to new businesses that start in its town.The company's financial analysts have developed the following cost information:

On average,each account generates $180 per year in fees and interest.After inquiring whether the costs above are all differential,you learn that the $200,000 per year cost to acquire accounts includes $30,000 of advertising that ChoiceBank would have done with or without the new accounts.The remainder of the $200,000 costs are differential.Further,you learn that $10 of the $150 to process and service accounts are general office costs allocated to these accounts,which are incurred whether or not the bank has the new accounts.The bank has an average of 7,000 new business commercial accounts each year.

Required:

Should ChoiceBank continue to offer these promotional new business accounts?

Correct Answer:

Verified

(ChoiceBank;customer profitability analy...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q40: Which product pricing practice is used by

Q41: The theory of constraints identifies bottlenecks and

Q42: Just-in-time is<br>A)a method of managing production by

Q43: Waldo Mining Company currently is operating at

Q44: When using differential analysis to determine when

Q46: What costs can be justified when managers

Q47: Explain the relation between costs and prices.

Q48: Which statement is true concerning target pricing?<br>A)Target

Q49: The objective of the theory of constraints

Q50: Which of the following is a valid