Essay

Activity-based costing in a nonmanufacturing environment.Green Thumb,Inc. ,is a lawn care service.The company originally specialized in serving residential clients but has recently started contracting for work with larger commercial clients.Mr.Green,the owner,is considering reducing residential services and increasing commercial lawn care.Five field employees worked a total of 10,000 hours last year-6,500 on residential jobs and 3,500 on commercial jobs.Wages were $9 per hour for all work done.Direct materials used were minimal and are included in overhead.All overhead is allocated on

the basis of labor hours worked,which is also the basis for customer charges.Because of greater competition for commercial accounts,Mr.Green can charge $22 per hour for residential work,but only $19 per hour for commercial work.

Required:

a.If overhead for the year was $62,000,what were the profits of commercial and residential service using labor hours as the allocation base?

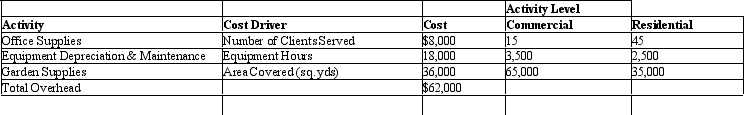

b.Overhead consists of office supplies,garden supplies,and depreciation and maintenance on equipment.These costs can be traced to the following activities:

Recalculate profits for commercial and residential services based on these activity bases.

c.What recommendations do you have for management?

Correct Answer:

Verified

a.Using Labor Hours

_TB2144_00 a$66,500...

_TB2144_00 a$66,500...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q90: Differentiate between traditional cost allocation methods and

Q91: Which of the following are examples of

Q92: The cost hierarchy can be used to

Q93: Which of the following are not capacity-sustaining

Q94: The law firm of Duwe,Cheatem & Howe

Q96: Marshall Manufacturing Co.<br>Marshall Manufacturing Co.uses an activity-based

Q97: Activity-based management can reduce customer response time

Q98: Discuss what is meant by the expression,"products

Q99: Thefirst step in activity-based costing (ABC)is to<br>A)identify

Q100: Marshall Manufacturing Co.<br>Marshall Manufacturing Co.uses an activity-based