Multiple Choice

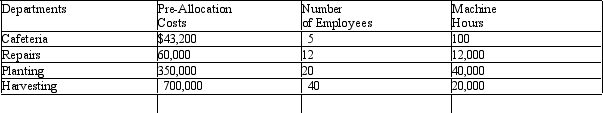

Pine Tar Forest Products has two production departments (Planting and Harvesting) and two service departments (Cafeteria and Repairs) .The service department costs must be allocated to production departments.Management has decided to allocate the cost of the cafeteria to other departments based upon the average number of employees and the cost of the Repairs Department based upon the number of machine hours used.

Regardless of the allocation method used,Pine Tar Forest Products always starts the allocation process with the Cafeteria Department.

If Pine Tar Forest Products distributes costs directly (direct method) from service departments to productions departments,what additional overhead costs should be allocated from the service departments to the Planting Department?

A) $56,800

B) $54,400

C) $35,940

D) $67,200

Correct Answer:

Verified

Correct Answer:

Verified

Q48: How is activity-based costing used to allocate

Q49: Waterbury Box Company<br>General Factory Administration and Maintenance

Q50: Why is activity-based costing used to allocate

Q51: Waterbury Box Company<br>General Factory Administration and Maintenance

Q52: Stephanie Company<br>Stephanie Company has two production departments:

Q54: Charley's Products allocates telephone expenses based on

Q55: Northstar Timber processes timber into Grade A

Q56: Jamar Company has two production departments,Tubing and

Q57: Why are joint-process costs allocated?<br>A)Used for performance

Q58: How are joint-process costs allocated?