Essay

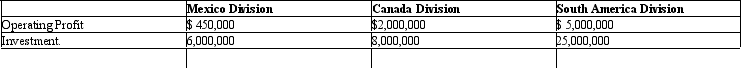

The following information relates to the operating performance of three divisions of Santos,Inc.for last year.

Required:

a.Compute the rate of return on investment (ROI)of each division for last year.

b.Assume that the firm levies a charge on each division for the use of funds.The charge is 10 percent on investment,and the accounting system deducts it in measuring divisional net income.Recalculate ROI using divisional net income after deduction of the use-of-funds charge in the numerator.

c.Which of these two measures do you think gives the better indication of operating performance? Explain your reasoning.

Correct Answer:

Verified

a.

_TB2144_00 b.

_TB2144_00 b.

_TB2144_00 c.As the a...

_TB2144_00 c.As the a...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q20: Because tax rates are different in different

Q21: Which of the following is(are)the transfer price

Q22: Framing Division<br>The Framing Division had the following

Q23: What has spawned a major political issue

Q24: Framing Division<br>The Framing Division had the following

Q26: Engine Division<br>The Engine Division provides engines for

Q27: A shortcoming of return on investment (ROI)is

Q28: What transfer pricing mechanism generally applies a

Q29: Dukes Computing Systems<br>Dukes Computing Systems manufactures and

Q30: Young Company has a tax rate of