Essay

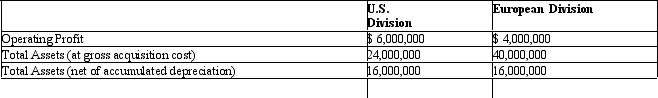

The following information relates to the operating performance of two divisions of Sound Machine,Inc. ,for last year.

Required:

a.Compute the return on investment (ROI)of each division,using total assets at gross book value as the investment base.

b.Compute the ROI of each division,using total assets net of accumulated depreciation (net book value)as the investment base.

c.Which of the two measures do you think gives the better indication of operating performance? Explain your reasoning.

Correct Answer:

Verified

a.U.S.Division: $6,000,000/$24,000,000 =...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q44: If the investment turnover ratio increased by

Q45: What are the transfer pricing issues and

Q46: When measuring a division's operating costs,labor used

Q47: Which of the following is a disadvantage

Q48: When measuring divisional operating costs,direct versus indirect

Q50: Is there an optimal transfer pricing policy

Q51: Which statement is true concerning economic value

Q52: Which of the following defines Economic value

Q53: Which statement is true concerning the establishment

Q54: Which of the following is the correct