Multiple Choice

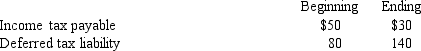

Sneed Corporation reported balances in the following accounts for the current year:

Income tax expense was $230 for the year.What was the amount paid for taxes?

A) $280.

B) $220.

C) $210.

D) $190.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q9: The amortization of bond discount is included

Q26: Listed below are reporting classifications for a

Q27: Hogan Company had the following account balances

Q32: In a statement of cash flows using

Q35: Ludwig Company's prepaid rent was $9,000 at

Q36: Following are the income statement and some

Q112: In determining cash flows from operating activities

Q139: Which of the following would be added

Q169: Which of the following is not classified

Q188: Cash equivalents have each of the following