Multiple Choice

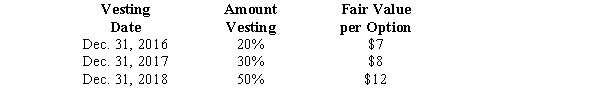

Green Company is a calendar-year U.S.firm with operations in several countries.At January 1,2016,the company had issued 40,000 executive stock options permitting executives to buy 40,000 shares of stock for $25.The vesting schedule is 20% the first year,30% the second year,and 50% the third year (graded-vesting) .The fair value of the options is estimated as follows:

Assuming Green uses the straight-line method,what is the compensation expense related to the options to be recorded in 2017?

A) $130,667.

B) $200,000.

C) $333,333.

D) $400,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q34: XYZ paid $10,000 in dividends in January

Q120: Basic earnings per share is computed using:<br>A)

Q125: If a company reports discontinued operations, EPS

Q167: The calculation of diluted earnings per share

Q169: On January 1,2016,Albacore Company had 300,000 shares

Q170: What is Rudyard's diluted EPS (rounded)?<br>A)$2.13.<br>B)$2.67.<br>C)$3.20.<br>D)$4.80.

Q172: When a company's income statement includes discontinued

Q175: Listed below are five terms followed by

Q177: Getaway Travel Company reported net income for

Q193: Restricted stock units (RSUs):<br>A) are a grant