Essay

Use the following to answer questions

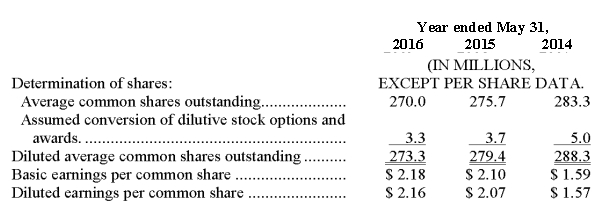

In its 2016 Annual Report to shareholders,V Co.had the following disclosure note about its EPS:

NOTE 9 - EARNINGS PER SHARE:

The following represents the reconciliation from basic earnings per share to diluted earnings per share.Options to purchase 8.3 million and 9.7 million shares of common stock were outstanding at May 31,2016 and May 31,2015,respectively,but were not included in the computation of diluted earnings per share because the options' exercise prices were greater than the average market price of the common shares and,therefore,the effect would be antidilutive.No such antidilutive options were outstanding at May 31,2014.

-At the end of 2016,what is the maximum number of shares that could possibly be issued if all stock options and awards are exercised? Explain why V Co.used only 3.3 million in its computation for 2016.

Correct Answer:

Verified

A total of 11.6 million shares is the ma...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q15: The calculation of diluted earnings per share

Q18: Sugarland Industries reported a net income of

Q22: When a company's income statement includes discontinued

Q24: What would be the total compensation indicated

Q27: What will Angel report as diluted earnings

Q31: If a company's capital structure includes convertible

Q118: Under IFRS, a deferred tax asset for

Q148: In computing diluted earnings per share, the

Q154: If a stock split occurred, when calculating

Q181: Earnings per share data is required to