Essay

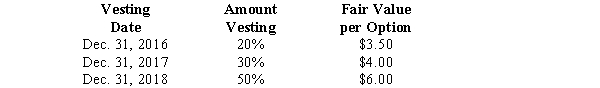

Pastner Brands is a calendar-year firm with operations in several countries.As part of its executive compensation plan,at January 1,2016,the company had issued 20 million executive stock options permitting executives to buy 20 million shares of stock for $25.The vesting schedule is 20% the first year,30% the second year,and 50% the third year (graded-vesting).The fair value of the options is estimated as follows:

Required:

Determine the compensation expense related to the options to be recorded each year for 2016-2018,assuming Pastner prepares its financial statements in accordance with International Financial Reporting Standards (IFRS).

Correct Answer:

Verified

The compensation cost is all...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

The compensation cost is all...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q39: Cartel Products Inc.offers a restricted stock award

Q41: On January 1,2016,Red Inc.issued stock options for

Q42: Wilson's compensation expense in 2016 for these

Q45: On December 31,2015,Merlin Company had outstanding 400,000

Q46: Under its executive stock option plan,Z Corporation

Q47: Red Company is a calendar-year U.S.firm with

Q58: If a stock dividend were distributed, when

Q72: Why are preferred dividends deducted from net

Q114: When several types of potential common shares

Q228: If restricted stock is forfeited because an