Multiple Choice

Use the following to answer questions

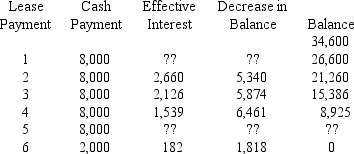

Refer to the following lease amortization schedule.The five payments are made annually starting with the inception of the lease.A $2,000 bargain purchase option is exercisable at the end of the five-year lease.The asset has an expected economic life of eight years.

-What would the lessee record as annual depreciation on the asset using the straight-line method,assuming no residual value?

A) $3,325.

B) $6,920.

C) $4,325.

D) $5,320.

Correct Answer:

Verified

Correct Answer:

Verified

Q5: A noncancelable lease contains a bargain purchase

Q6: Costs incurred by the lessor that are

Q7: Use the following to answer questions <br>Refer

Q8: What lease disclosures are required of the

Q11: Listed below are several terms and phrases

Q12: If the lessor records deferred rent revenue

Q13: Savinsky Industries prepares its financial statements using

Q14: Distinguishing between operating and capital leases is

Q15: Which of the following statements characterizes a

Q141: Refer to the following lease amortization schedule.