Short Answer

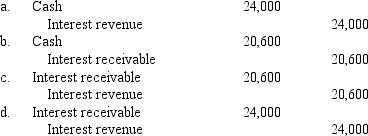

On January 1,2016,Calloway Company leased a machine to Zone Corporation.The lease qualifies as a direct financing lease.Calloway paid $240,000 for the machine and is leasing it to Zone for $34,000 per year,an amount that will return 10% to Calloway.The present value of the minimum lease payments is $240,000.The lease payments are due each January 1,beginning in 2016.What is the appropriate interest entry on December 31,2016?

Correct Answer:

Verified

Correct Answer:

Verified

Q42: Prepayments made by the lessee on an

Q43: Discuss the three major types of leases

Q44: Each of the independent situations below describes

Q45: Hamilton Security leased equipment to American Parcel

Q46: Warren Co.recorded a right-of-use asset of $800,000

Q49: For the lessee to account for a

Q50: ABC Company leased equipment to Best Corporation

Q51: On January 1,2016,Salvatore Company leased several machines

Q52: What is the book value of the

Q146: If the leaseback portion of a sale-leaseback