Multiple Choice

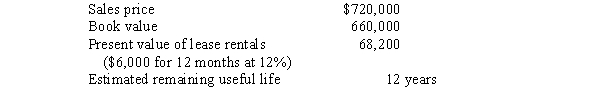

On December 31,2016,B Corp.sold a machine to Royal and simultaneously leased it back for one year.Pertinent information at this date follows:

In B's December 31,2016,balance sheet,the deferred revenue from the sale of this machine should be:

A) $ 0.

B) $ 8,200.

C) $60,000.

D) $68,200.

Correct Answer:

Verified

Correct Answer:

Verified

Q82: Francisco leased equipment from Julio on December

Q83: Blue Co.recorded a right-of-use asset of $100,000

Q84: Of the four criteria for a capital

Q85: How do U.S.GAAP and International Financial Reporting

Q87: When the lessee guarantees an estimated residual

Q88: In this situation,Reagan:<br>A)is the lessee in a

Q89: On January 1,2016,Princess Corporation leased equipment to

Q90: On a sale-leaseback transaction,any gain on the

Q91: A direct financing lease is classified in

Q156: Refer to the following lease amortization schedule.