Multiple Choice

Assume that,on January 1,2016,Sosa Enterprises paid $3,000,000 for its investment in 36,000 shares of Orioles Co.Further,assume that Orioles has 120,000 total shares of stock issued and estimates an eight-year remaining useful life and straight-line depreciation with no residual value for its depreciable assets.

At January 1,2016,the book value of Orioles' identifiable net assets was $7,000,000,and the fair value of Orioles was $10,000,000.The difference between Orioles' fair value and the book value of its identifiable net assets is attributable to $1,800,000 of land and the remainder to depreciable assets.Goodwill was not part of this transaction.

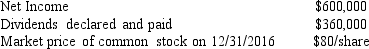

The following information pertains to Orioles during 2016:

What amount would Sosa Enterprises report in its year-end 2016 balance sheet for its investment in Orioles Co.?

A) $3,200,000.

B) $3,180,000.

C) $3,135,000.

D) $3,027,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q30: All securities considered available for sale should

Q74: When an equity method investment is sold,

Q77: In the statement of cash flows, inflows

Q120: In the statement of cash flows, inflows

Q138: On April 1,2016,BigBen Company acquired 30% of

Q139: Smith buys and sells securities,which it typically

Q140: Which of the following is not true

Q143: If an investment is accounted for under

Q146: A weakness of _?_ is that firms

Q148: On January 2,2016,MBH Inc.acquired 30% of the