Short Answer

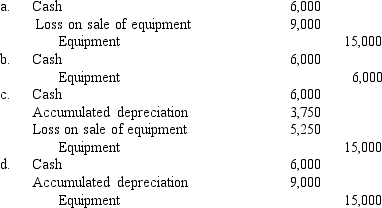

An asset acquired January 1,2016,for $15,000 with an estimated 10-year life and no residual value is being depreciated in an equipment group asset account that has an average service life of eight years.The asset is sold on December 31,2017,for $6,000.The entry to record the sale would be:

Correct Answer:

Verified

Correct Answer:

Verified

Q6: Briefly discuss why straight-line is the most

Q42: Required:<br>Compute depreciation for 2016 and 2017 and

Q43: Required:<br>Compute depreciation for 2016 and 2017 and

Q44: Jung Inc.owns a patent for which it

Q46: Listed below are five terms followed by

Q48: Wilson Inc.owns equipment for which it paid

Q49: Using the sum-of-the-years'-digits method,depreciation for 2016 and

Q50: In 2015,Antle Inc.had acquired Demski Co.and recorded

Q118: An asset should be written down if

Q176: Once selected for existing assets, a company