Short Answer

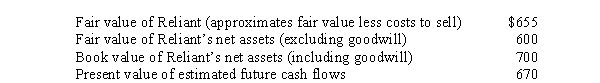

Kingston Corporation has $95 million of goodwill on its books from the 2014 acquisition of Reliant Motors.At the end of its 2016 fiscal year,management has provided the following information for its required goodwill impairment test ($ in millions):

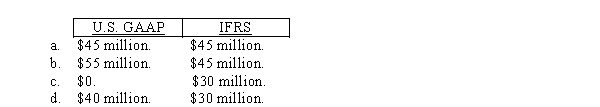

Assuming that Reliant is considered a reporting unit for U.S.GAAP and a cash-generating unit for IFRS,the amount of goodwill impairment loss that Kingston should recognize according to U.S.GAAP and IFRS,respectively,is:

Correct Answer:

Verified

Correct Answer:

Verified

Q1: The replacement of a major component increased

Q3: Granite Enterprises acquired a patent from Southern

Q6: Compute depreciation for 2016 and 2017 and

Q7: At the end of its 2016 fiscal

Q10: Using the straight-line method,depreciation for 2016 and

Q53: In 2017, Dooling Corporation acquired Oxford Inc.

Q77: A change in the estimated recoverable units

Q82: Any method of depreciation should be both

Q133: Short Corporation acquired Hathaway, Inc., for $52,000,000.

Q136: The legal life of a patent is:<br>A)