Essay

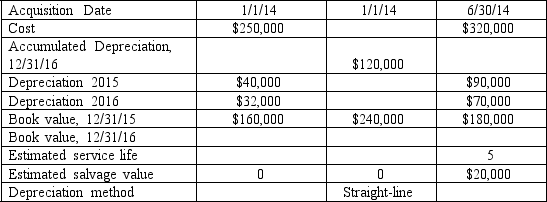

The table below contains data on depreciation for machinery.

Required: Fill in the missing data in the table.

Correct Answer:

Verified

Correct Answer:

Verified

Q70: On September 30,2016,Morgan,Inc.acquired all of the outstanding

Q72: Using the double-declining balance method,depreciation for 2016

Q73: Nanki Corporation purchased equipment on January 1,2014,for

Q74: In December of 2016,XL Computer's internal auditors

Q79: Depreciation (to the nearest dollar)for 2016,using sum-of-the-years'

Q86: International Financial Reporting Standards (IFRS) require goodwill

Q99: Briefly differentiate between activity-based and time-based allocation

Q158: MACRS (modified accelerated cost recovery system) depreciation

Q180: Briefly explain the differences between the terms

Q222: Statutory depletion is the maximum amount of