Essay

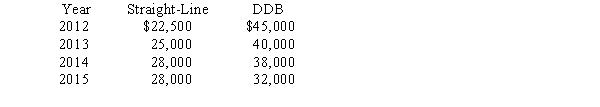

Weaver Textiles Inc.has used the straight-line method to depreciate its equipment since it started business in 2012.At the beginning of 2016,the company decided to change to the double-declining-balance (DDB)method.Depreciation as reported and as it would have been reported if the company had always used DDB is listed below:

Required:

What journal entry,if any,should Weaver make to record the effect of the accounting change (ignore income taxes)? Explain.

Correct Answer:

Verified

The change in depreciation method is tre...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q115: Activity-based methods of depreciation are appropriate for

Q123: On February 20,2016,Genoa Mining Company incurred costs

Q124: Broadway Ltd.purchased equipment on January 1,2014,for $800,000,estimating

Q125: Gonzaga Company has used the double-declining-balance method

Q126: The depreciable base for an asset is:<br>A)Its

Q127: Murgatroyd Co.purchased equipment on January 1,2014,for $500,000,estimating

Q128: Required:<br>Compute depreciation for 2016 and 2017 and

Q129: Using the double-declining balance method,the book value

Q130: Listed below are five terms followed by

Q131: El Dorado Foods Inc. owns a chain