Multiple Choice

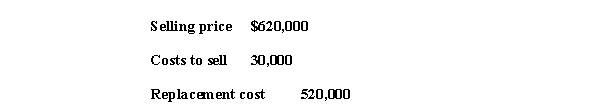

Montana Co.has determined its year-end inventory on a FIFO basis to be $600,000.Information pertaining to that inventory is as follows:

What should be the reported value of Montana's inventory?

A) $600,000.

B) $520,000.

C) $590,000.

D) $620,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q15: The denominator for the current period's cost-to-retail

Q16: In the following questions, inventory errors are

Q19: The primary motivation behind the lower of

Q20: Listed below are five terms followed by

Q22: For a purchase commitment extending beyond the

Q22: Hawkeye Auto Parts uses the average cost

Q63: Using the dollar-value LIFO retail method for

Q68: Under the conventional retail method, which of

Q104: Briefly outline the steps in the gross

Q110: Under the retail inventory method:<br>A) A company