Multiple Choice

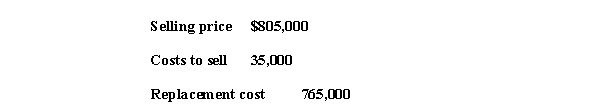

Haskell Corporation has determined its year-end inventory on a FIFO basis to be

$785,000.Information pertaining to that inventory is as follows:

What should be the reported value of Haskell's inventory if the company prepares its

Financial statements according to International Financial Reporting Standards (IFRS) ?

A) $765,000.

B) $785,000.

C) $770,000.

D) $750,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q36: Purchase returns and purchase discounts are ignored

Q87: Under the LIFO retail method, which of

Q108: The average cost-to-retail percentage is:<br>A)52.2%.<br>B)61.5%.<br>C)56.8%<br>D)55%.

Q109: California Inc. ,through no fault of its

Q111: Inventory is valued at the lower of

Q112: Briefly explain the differences between U.S.GAAP and

Q114: In applying the lower of cost and

Q115: Listed below are five terms followed by

Q116: What should be the reported value of

Q136: Briefly explain the financial reporting required when