Essay

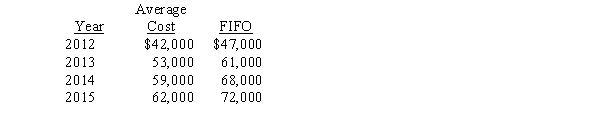

Orlando Company has used the average cost method for inventory valuation since it began business in 2012,but has elected to change to the FIFO method starting in 2015.Year-end inventory valuations under each method are shown below:

Required:

How would Orlando reflect the change in accounting principle in its financial statements (ignore income taxes)?

Correct Answer:

Verified

Orlando would revise prior years' financ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q36: The numerator for the current period's cost-to-retail

Q37: An inventory written down due to the

Q38: New York Sales Inc.uses the conventional retail

Q40: In applying the lower of cost and

Q41: When changing from the average cost method

Q42: An argument against use of the lower

Q43: Estimated ending inventory at cost is:<br>A)$90,720.<br>B)$83,500.<br>C)$91,600.<br>D)None of

Q44: In applying the lower of cost and

Q93: A change from LIFO to any other

Q151: For a purchase commitment contained within a