Short Answer

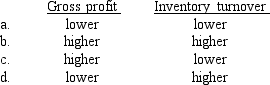

Company A is identical to Company B in every regard except that Company A uses FIFO and Company B uses LIFO.In an extended period of rising inventory costs,Company A's gross profit and inventory turnover ratio,compared to Company B's,would be:

Correct Answer:

Verified

Correct Answer:

Verified

Q2: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2599/.jpg" alt=" -Required: Compute the

Q80: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2599/.jpg" alt=" -Required: Compute the

Q97: Dollar-value LIFO eliminates the risk of LIFO

Q99: Suppose that Badger's 2018 ending inventory,valued at

Q100: Listed below are 5 terms followed by

Q101: Company C is identical to Company D

Q106: The ending inventory assuming FIFO is:<br>A)$5,140.<br>B)$5,080.<br>C)$5,060.<br>D)$5,050.

Q107: The following information is taken from the

Q108: What is Nueva's gross profit ratio (rounded)if

Q109: Tiger Inc.adopted dollar-value LIFO on January 1,2016,when