Essay

Carmen Inc. ,producer of high-tech boating equipment,disclosed the following information in its 2016 annual report to shareholders:

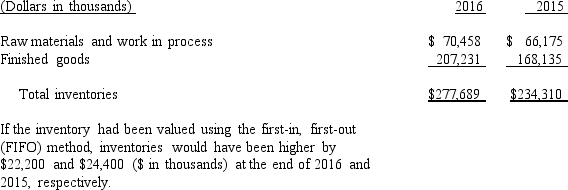

Inventories are valued at the lower of cost or net realizable value with cost determined by the last-in,first-out (LIFO)method for inventories.

Inventories at May 31 were as follows:

How does the supplemental LIFO information indicating what the value of ending inventory would have been if measured using FIFO improve the quality of financial reporting by Carmen?

Correct Answer:

Verified

By providing this information,external d...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q3: During periods of falling prices, LIFO ending

Q11: The following information comes from the 2013

Q12: On January 1,2015,RAY Co.adopted the dollar-value LIFO

Q15: The following information is taken from the

Q17: The ending inventory assuming LIFO and a

Q18: Ending inventory assuming LIFO in a perpetual

Q20: During 2016,WW Inc.reduced its LIFO eligible inventory

Q21: The Foxworthy Corporation uses a periodic inventory

Q134: The main difference between perpetual and periodic

Q157: Costs and prices regularly fall every year