Short Answer

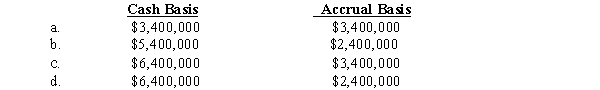

On June 1,Royal Corp.began operating a service company with an initial cash investment by shareholders of $2,000,000.The company provided $6,400,000 of services in June and received full payment in July.Royal also incurred expenses of $3,000,000 in June that were paid in August.During June,Royal paid its shareholders cash dividends of $1,000,000.What was the company's income before income taxes for the two months ended July 31 under the following methods of accounting?

Correct Answer:

Verified

Correct Answer:

Verified

Q19: The income statement summarizes the operating activity

Q21: Mary Parker Co.invested $15,000 in ABC Corporation

Q22: When converting an income statement from a

Q25: Listed below are five terms followed by

Q26: Prepare an income statement for China Tea

Q28: Use the following to answer questions <br>The

Q55: What is the difference between permanent accounts

Q73: Temporary accounts would not include:<br>A) Salaries payable.<br>B)

Q103: Examples of external transactions include all of

Q220: From the following choices, select the answer